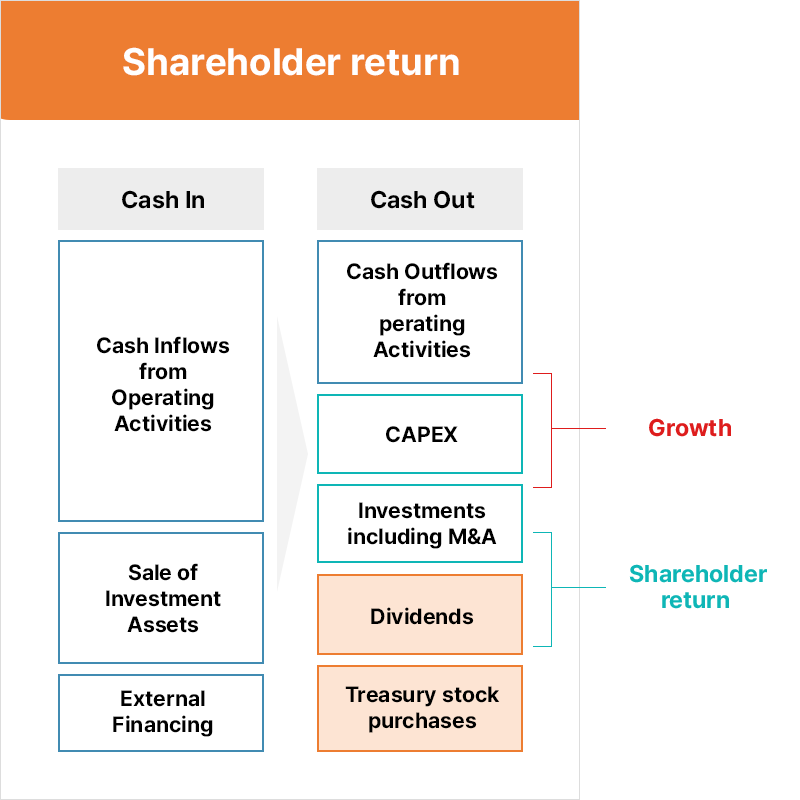

Dreantech’s responsible shareholder return policy

seeks to balance future growth with shareholder returns.

Shareholder return policy

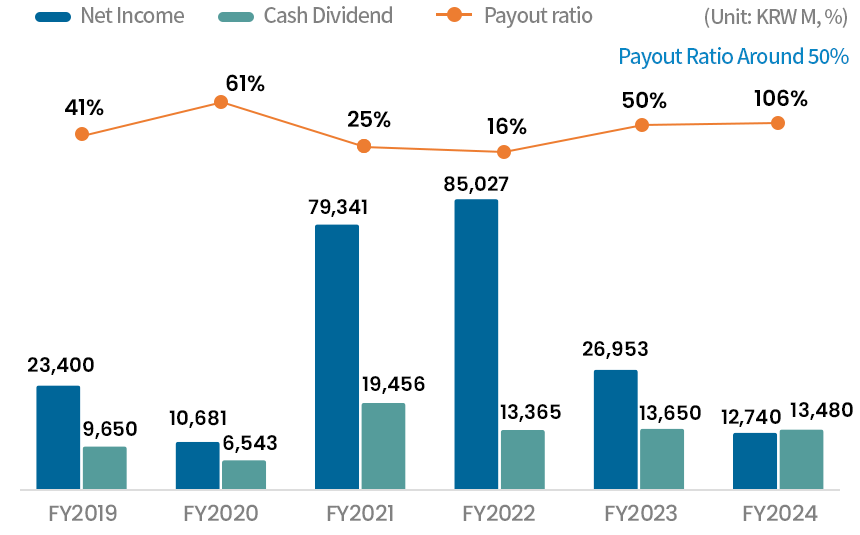

Note: (*) Shareholder Return Ratio = (Dividends + Treasury stock purchases) / net income attributable to controlling shareholders.

Dividends

| Category | FY2019 (22nd) |

FY2020 (23nd) |

FY2021 (24nd) |

FY2022 (25nd) |

FY2023 (26nd) |

FY2024 (27nd) |

|---|---|---|---|---|---|---|

| Dicidend Yield (%) | 2.4 | 0.9 | 2.5 | 2.2 | 1.5 | 5.4 |

| Dicidend per Share (KRW) | 160 | 100 | 300 | 200 | 200 | 200 |

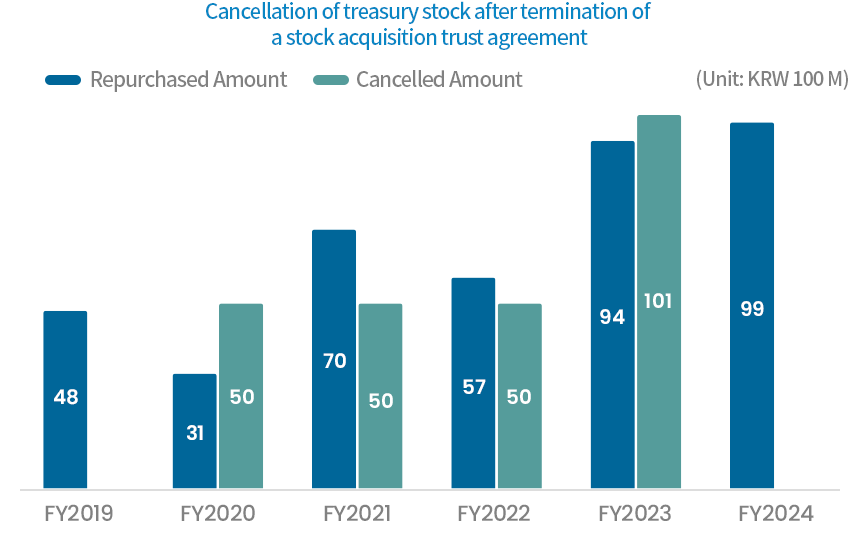

Share Repurchase